Return Of Premium Term Life Insurance Canada

Unlike traditional term life insurance, however, return of premium insurance returns your premiums at the end of the term. By using our online quote engine, you will receive a comprehensive list of 25+ canadian companies showing precisely which companies have your lowest life insurance rates.

Your Guide To Term Life Insurance in 2020 Term life

What is return of premium life insurance?

Return of premium term life insurance canada. With return of premium (rop) life insurance, you’ll pay a flat rate for the duration of your policy, but you’ll get all your money back at the end of the term. 20, 25, or 30 years. While there are many excellent term life insurance policies available, term with return of premium from aaa life ensures you’ll receive 100% of your premiums back at the end of the term period if coverage is never used.

If you don’t die during its term, you’ll receive all or a portion of the premiums you have paid into the policy. This implies that if you, as the insured, survive till the maturity. You receive an automatic return of 75% of the returnable premiums on the later of the 15th policy anniversary or the policy anniversary nearest the child’s 25th birthday.

To address this, life insurance companies are offering term insurance plans with a return of premium option. Any waiver of premium for disability rider premiums returned as part of the return of premium benefit may be taxable. At the touch of your fingertips, termcanada shops the term life insurance market in canada to give you the best rates available.

For example, if you pay one of your employees $1,000 and also pay $200 for life insurance premiums on his behalf, you must withdraw income tax and remit payroll tax as if you paid your employee $1,200 for that pay period. Line 10400 was line 104 before tax year 2019. We do not really expect to pass away during that time.

Term insurance return of premium is a variant of term insurance plan: A group term life insurance policy is a policy where the only amounts payable by the insurer are policy dividends, experience rating refunds, and amounts payable on the death or disability of an employee or former employee. Life insurance transfers your financial risk of death to a life insurance company.

A term plan with return of premium (trop), on the other hand, is a term plan with an additional feature of a survival benefit. 2 unpaid loans and withdrawals will reduce the guaranteed death benefit, policy cash value, and any return of premium benefits. If your application passed through underwriting, that is a good indication that the life insurance company does not expect you to pass away either.

If you die, your survivors receive the death benefit. If you outlive the policy, the coverage ends and you don't get any money. Guaranteed cash value beginning as early as year 3.

Guaranteed premiums for life or until the policy is paid up. How return of premium policies work. How does return of premium term life pay you back?

Effective january 2018, employers who pay group term life insurance premiums on behalf of retirees, when it’s the only income reported on the t4a slip, are only required to report the premium if the amount is greater than $50. The return of premium life insurance provides a middle ground between term and whole life insurance. 1 the return of premium benefit on the base policy is not taxable.

In most cases, life insurance premiums are considered a taxable benefit. A pure term life cover is an insurance policy that promises to pay your nominee an amount (sum assured of the policy), if you die. Accordingly, you must include their value when calculating payroll and income tax for your employees.

Your former employee is still responsible for reporting the amount on his or her personal income tax and benefits return. But it doesn’t come bundled with investment, unlike traditional. Term plan return of premium offers insurance coverage as death benefit along with the benefit of the return of premium as survival benefit in case the insured survives the entire tenure of the policy.

A return of premium policy fulfills the life insurance obligation and returns the premiums if one or both of the partners live past the term. When it comes time to make a claim, we’re here to help make the process as quick and easy as possible. It means that if the life assured continues to live through the policy tenure then at the end of policy term the life insurance company returns all the premium paid towards the policy.

You pay a fixed annual premium. A return of premium life insurance policy is a type of term life insurance, meaning it lasts a set period of time and then expires. Advanced return of premium, for plans that are paid over the life of the policy.

Since the return of premium rider ensures against the loss of premiums, it can seem like an attractive option—even if it's really a poor deal. How an rop policy works. Choose from 10, 15 or 20 years or to age 100 as your premium payment option.

How does return of premium life insurance work? Your insurance operates within a set time with one significant difference. A traditional term life insurance policy may give you an option of 15, 20 or 30 years.

In order for that arrangement to make financial sense to your insurer, it. In a pure term plan, the insurance coverage is offered only as a death benefit. At the end of the term, you get all of the premiums you paid back, as long as you made all.

In return for your premiums, the company promises a payout to your family to cover certain expenses and needs. Return of premium life insurance — or refundable life insurance — combines regular term life insurance with a return of premium feature.you choose the term: But even we buy a term policy that that will last for decades;

You can select from 4 premium payment options.

Are you thinking about buying Term life insurance? See

How can Canada's term life insurance products stack up

Nature her beauty and the wonders found within her embrace

What Are All The Documents Required For EFiling tax

Best Cash Back Credit Cards in Canada 2019 Best travel

Most recent Snap Shots lifeinsurancepolicy

Infographic Millennialls & Life Insurance

HP Premier Plus Inkjet Print Photo Paper Letter 8 1/2

Ethos Life Insurance Review Get Coverage in Under 10

Connecticut Life Insurance Policies Paradiso Insurance

Bestow Review Get Affordable Term Life Insurance Online

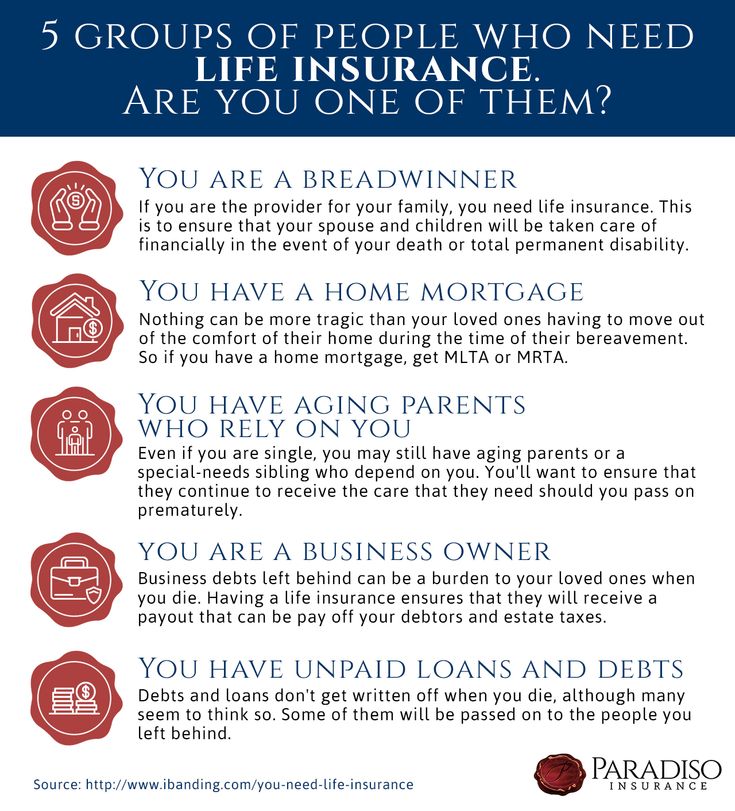

If you buy a life insurance then you protect your loved

Pin by Life Insurance Expertise on Learn About Life

Tax Trivia The word “tax” originates from the Latin verb

Useful Suggestions For The Insurance Issues Commercial