Purpose Of Insurance Companies

The fundamental purpose of insurance is to spread out the risk of individual investments among many parties to reduce the risk to any individual member of the pool in the event that an investment fails. Business insurance helps protect a company's financial assets and property from loss.

5 tips to know when your car needs maintenance

A captive insurance company is one that typically insures the risks of a specific industry or group of individuals or a specific type of risk such as shipping (transit insurance) and fleet insurance.

Purpose of insurance companies. These companies reimburse the financial cost of a particular event against the premium they collect from people who purchases the policy from them. During real estate transactions, title companies are hired to investigate the history of the title to verify information and identify encumbrances. If insurance companies stopped playing physician, and stopped creating extra busy work for physicisns, then physicians could have more time to do their.

A list of insurance companies they need to apply for. A life insurance policy is a policy people take out with a life insurance company to provide a sum of money when they die. Medicare statement and patient agreement

Help mitigate delays as much as you can. What is the purpose of life insurance? The main purpose of doing so is to avoid using traditional commercial insurance companies, which have volatile pricing and may not meet the specific needs of the company.

By creating their own insurance company, the parent company can reduce their costs, insure difficult risks, have direct access to reinsurance markets, and increase cash flow. We understand that economical factors sometimes hinder and deter clients from seeking treatment which is why we tailor treatment costs to be fair, affordable, and sustainable without compromising quality. Learn more about business insurance and what the purpose of business insurance is from the experts at the hartford.

When you are not protected ( i.e., not insured ), you will not be compensated for your loss. 3) keeping track of your staffs credentialing status. The purpose of insurance is to reduce your business' exposure to the.

Insurance companies use deductibles to ensure policyholders have skin in the game and will share the cost of any claims. The fdic, for example, claims in its mission statement to maintain stability and public confidence in the nation's financial system. Insurance companies sell policies for individuals, families and businesses to provide financial protection in case of a claim or loss.

Our fees are structured to accommodate both those with and without insurance coverage. It is essential to know where your staff is with their credentialing and what the cause of delay if any is. Purpose can generate topline growth (or serve as an insurance policy against revenue slippage) by creating more loyal customers, fostering trust, and preserving your customer base at a time when 47 percent of consumers disappointed with a brand’s stance on a social issue stop buying its products—and 17 percent will never return.

Life insurance policies are designed to achieve several aims. I understand the purpose better than you. That’s basically what the purpose of insurance is, to provide you with a form of protection against a possible risk.

It is an alternative to the traditional market and is a risk management tool that can be designed to meet and/or assist in meeting the risk management needs of its owners or members. The audit then determines the amount of your final premium. When you are protected, you will be compensated for your loss.

They do this while harming the health of those members who do not fit the medical profile of the average member, i.e., are statistical outliers. Insurance companies usually provide financial coverage of the loss that an individual is expected to suffer due to unforeseen events, and hence reduces the impact of a certain event. Remember, delays in credentialing can result in delays in payments and loss of your practice.

Didn't read) the function of an insurance company is to help assess your risks and provide you. A captive insurance company is an insurance company that insures or reinsures the risks of its parent, affiliates or certain unrelated entities. These include providing for one's final expenses such as funeral costs and serving as a financial cushion for one's family.

Insurance companies want to improve the health of their average members so they pay less in claims. A captive insurance company may be. For example, if a shipping business could not find affordable coverage through the standard insurance market, it may form a company to provide insurance for itself.

Find out what insurance is best for your business today. The purpose of insurance premium audits is to use actual sales and operations data to determine how accurate their guess was.

LA insurance agency provides you cheap Auto insurance

responsive life insurance company free quote lead

In Motor Insurance vehicles are broadly classified into

Do You Know What Info Insurance Companies Have On You

Image result for why you need to reinsurance reinstatement

Insurance Agency Business Postcard , Affiliate, Flyer

Flat Roof Insurance Flat roof, Home insurance quotes

Outsourcing in the Field of Insurance Claim Processing

What Is The Purpose Of Having Homeowners Insurance in 2020

Home Insurance Business Purposes order Dave Ramsey...

Role of Life Insurance Adjuster insurance insurancecost

Callbox Revs Up Tax Consulting Firm’s Sales Efforts Tax

Insurance Company Bifold / Halffold Brochure Insurance

Life Insurance a MultiPurpose Product Blog La Capitale

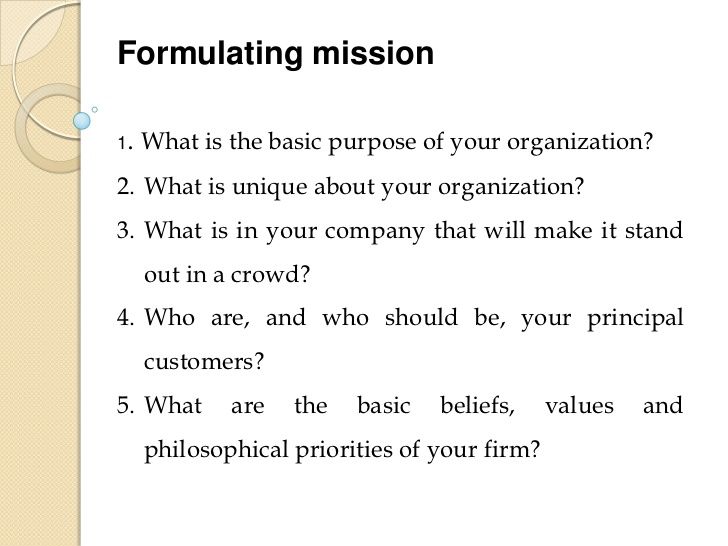

mission statement examples for schools Google Search

Create a Home Inventory for Insurance Purposes Low Car

How To Choose A Good Scope The Definitive Guide (2019

writing appeal letter soap format medical necessity

Insurance Ad I did for an health insurance agent, for