Micro Captive Insurance Companies

According to section 831(b) of the internal revenue code, a micro captive may pay taxes on investment income. This allows them to manage risk while avoiding the volatility of traditional insurance or obtain coverage they could not receive commercially.

Pin by Inside Option on Inside option Offshore bank

It is a safe harbor allowing captive insurance companies with less than $1.2 million in annual written premium to be taxed on investment income alone.

Micro captive insurance companies. A micro captive is a small captive insurer that has special taxation rules. They can be owned by large conglomerates as well as local small businesses or farmers. A captive insurance company is an insurance company that is formed or owned by a related business owner or group of owners.

It provides coverage to that business against risks—risks that are often not readily insurable in the commercial market. Under section 831(b) of the internal revenue code, certain small insurance companies can choose to pay tax only on their investment income. If your business is actively participating in a captive insurance arrangement, now is the time to speak to a.

A captive insurance company is an insurance company that is formed or owned by a related business owner or group of owners. A captive insurance company is an insurer that is owned and operated by its insured. What is a micro captive?

Captive insurance companies enjoy certain tax advantages. Tax code — hence, their alternate designation of “831(b) captives.” captive resources’ (cri) approach to these smaller captives aligns with our overall group captive concept: • the irs is very active in auditing captive insurance companies.

While it's unclear how many captives and their owners this has impacted, the number may be more than 1,000. In this type of arrangement, a parent corporation creates a licensed insurance company to insure its interest. But the tests remain the same

If the captive’s annual premiums don’t exceed $2.3 million and it meets certain diversification requirements, the captive can make an election under internal revenue code §831(b) to not include premiums in income and only be taxed on investment income. The irs put micro captives on its “dirty dozen” enforcement target list for 2014. These are risks that business owners have determined not to cover though traditional commercial carriers for a number of.

Most captive insurance programs are entirely legal and not of interest to the irs. A micro captive is a small captive insurance company that’s taxed based on the stipulations of section 831(b) of the u.s. A “micro captive” is an insurance company that focuses on serving one taxpayer, or one group of taxpayers.

They are auditing for excise tax compliance, whether the arrangement is insurance for federal income tax purposes, whether the section 501(c)(15) and 831(b) rules have been met, etc. Companies (7 days ago) these code sections govern general insurance company taxation and the election available under 831 (b) for small captive insurance companies is very important.

3 Tips to an Independent Insurance Agent

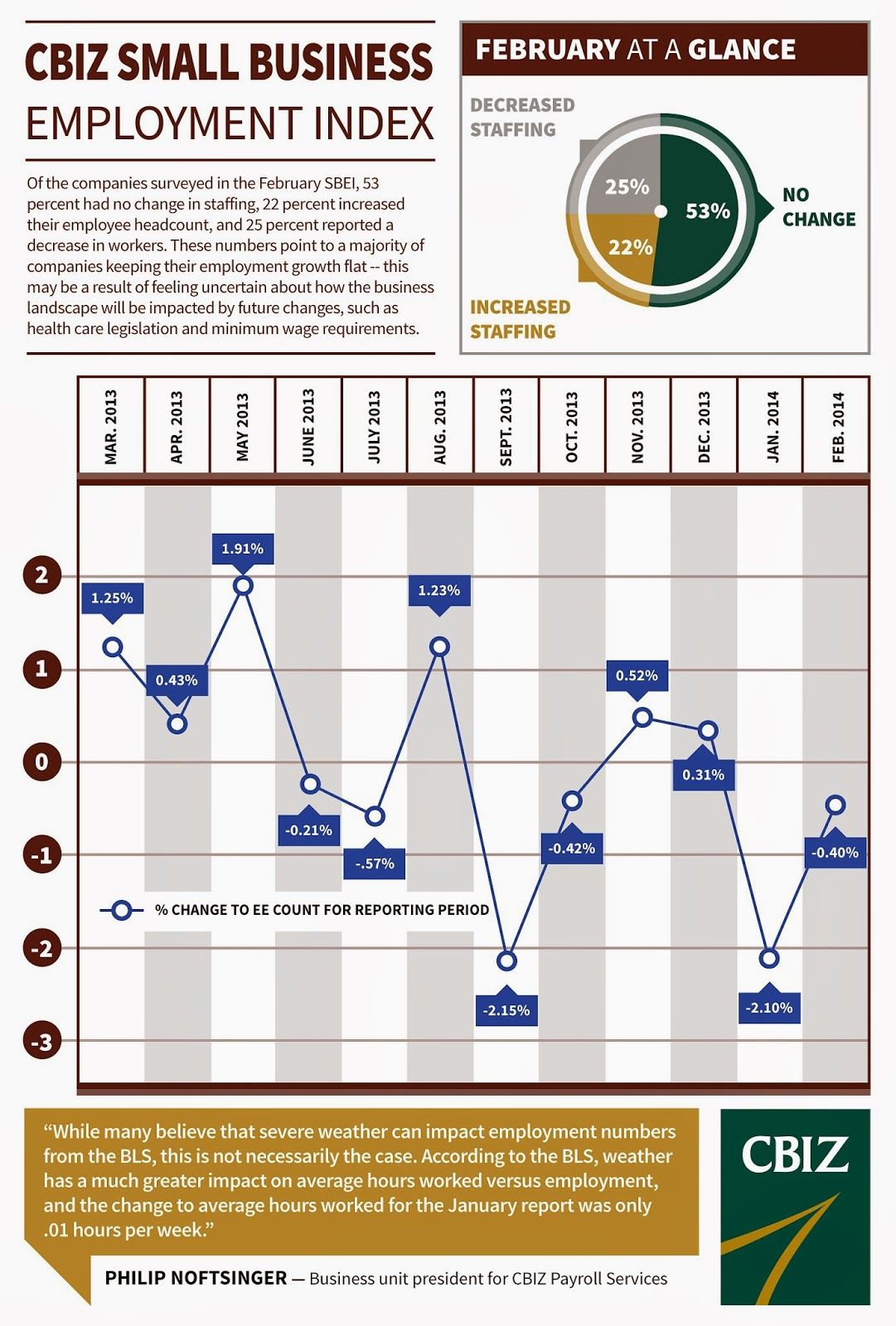

Slow start for 2014 hiring employment index

Technique how to earn new loyal customers in business

South Beach January 2012 (With images) Vacation trips

Mercedes A250 Sport Mercedes benz cars, Mercedes a class