Decreasing Term Life Insurance For Mortgage

Decreasing term life insurance is a type of life insurance policy that pays out less over time. The amount you are covered for decreases over the term of your policy, similar to the way a repayment mortgage decreases.

Some insurance companies offer incentives for paying an

The amount of mortgage life insurance can be decreasing or level.

Decreasing term life insurance for mortgage. A decreasing term life insurance policy is typically cheaper than a level term policy because the death benefit your beneficiaries would receive is reduced over time. It’s often used to cover the balance of a repayment mortgage, because the total balance of the mortgage decreases over time and will be paid off in full at the end of the term. Decreasing term life insurance is tied to a debt, like a mortgage or loan.

Our decreasing life insurance is a type of insurance that's designed to help protect a repayment mortgage. If you’re steadily paying off your mortgage , in the event of your death your dependants would need less money to cover what remains of it as time goes on. Convenience was their major selling point.

For decreasing mortgage life insurance, the type of mortgage usually covered is a repayment mortgage. It protects a repayment mortgage by mirroring the outstanding balance which reduces over time. Instead, loan officers such as mortgage brokers and f&i managers at car dealerships are the people who traditionally sell this type of life insurance.

You also agree how much your monthly payments will be and for how long you are covered (e.g. Mortgage protection or decreasing term life insurance is a policy where your cover amount goes down or ‘decreases’ over time which in turn lowers the monthly premiums throughout the duration of the policy. As this debt decreases over time, so will the amount of insurance.

What is decreasing term life insurance? Decreasing term life insurance is defined as a term life policy that provides the beneficiary a gradually decreasing death benefit over the life of the policy. It could pay out a cash sum if you die or you're diagnosed with a terminal illness with a life expectancy of less than 12 months, during the length of your policy.

Level term life insurance may be a better option, as it provides. How long until your mortgage is paid off). In the event that the policyholder dies the insurance payout would be sufficient to clear the outstanding mortgage balance.

Its decreasing cover falls roughly in line with the reducing balance on a repayment mortgage*. Decreasing term life insurance 👪 jun 2021. Life auto home health business renter disability commercial auto long term care annuity.

With mortgage life insurance you select a large payout amount that could be in line with the loan you want to cover at the beginning of the policy. Premiums are usually constant throughout the contract, and. The term length is equal to the timeframe of your loan.

Advantage of decreasing life insurance. What is decreasing term mortgage life insurance? A decreasing term assurance policy is usually the same as a mortgage term assurance policy.

Decreasing term life insurance is often used to cover a specific debt, like a mortgage. While you were completing your home loan paperwork to purchase your. These policies were popular before the 2008 housing and economic crisis.

A decreasing term mortgage life insurance policy specifically covers the outstanding balance on a mortgage. We occasionally help homeowners looking for decreasing term mortgage protection policies. Decreasing term life insurance definition.

A decreasing term mortgage policy can help you pay off your mortgage because the death benefits are specifically designed to decrease as you pay down the principal. This differs to level term life insurance, which will pay out a fixed amount if you die during the term, but costs you more in monthly premiums. Decreasing term insurance is renewable term life insurance with coverage decreasing over the life of the policy at a predetermined rate.

You may have also heard it called decreasing term life insurance. Decreasing life insurance is usually taken out alongside a mortgage. Decreasing term life insurance policies were convenient and easy to apply for during the financing process;

Most people encounter decreasing term life insurance as mortgage protection insurance (mpi). The death benefit will decrease on a monthly or annual basis. It's rare for life insurance agents/brokers to sell this type of life insurance.

As the benefit reduces with decreasing term life insurance, the risk to the insurer falls alongside it. This is because the payout reduces each month, similar to your mortgage balance after repayments. Our decreasing cover pays out a single amount that reduces over the term of the policy.

Mortgage life insurance is typically bought to cover a mortgage, so in the event of your death your loved ones can pay off your outstanding mortgage. Decreasing term life insurance is a special form of term life insurance designed to cover a borrowing obligation. Decreasing term life insurance is, as the name states, a term life insurance policy with a death benefit that shrinks over time.

One of the biggest advantages of decreasing mortgage term assurance is that the policy can be aligned with your mortgage, falling as the value of your outstanding mortgage debt falls over time. Mpi is a decreasing term life insurance policy that you purchase through your bank and may pay as part of your mortgage. In the event of your death, the life insurance company pays the death benefit directly to the mortgage company.

It was created with the notion that the insured’s need for coverage will decrease over time, as. Although payments stay the same over the term of the policy, how much you pay each month is typically less than for level term life insurance. Over the duration of the policy the benefit amount will decrease.

Decreasing term insurance is a life insurance product that provides decreasing coverage over the term of the policy. Each year, the payout and mortgage amount would decrease together.

5 insurance changes to make when you retire Life

Tips on insurance InsuranceTips Life insurance facts

Life is too short to be complacent or just go through the

10 Financial Points to Discuss Before Marriage Before

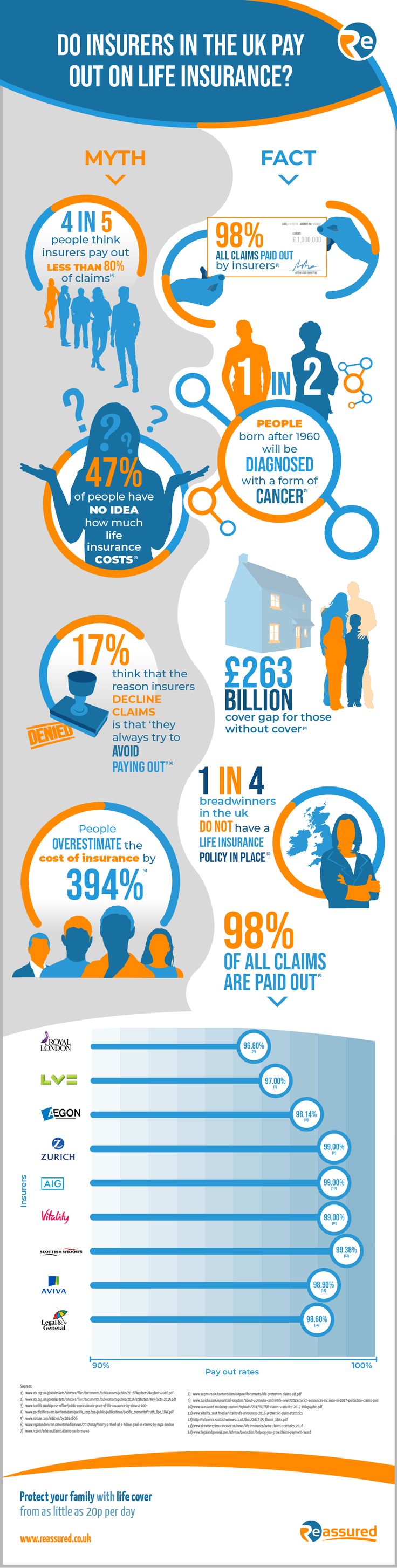

Recent research from a range of sources, including

Start Health insurance cost, Pay off mortgage early

Private Mortgage Insurance What Property Buyers Need to

How Tax Deductions Work Financial advisors, This or that