Why Is Insurance So Expensive For Young Drivers

New drivers have an unproven record: People between16 and 25 are likely to pay higher insurance rates than other age groups.

Young drivers Save £257 on car insurance Car insurance

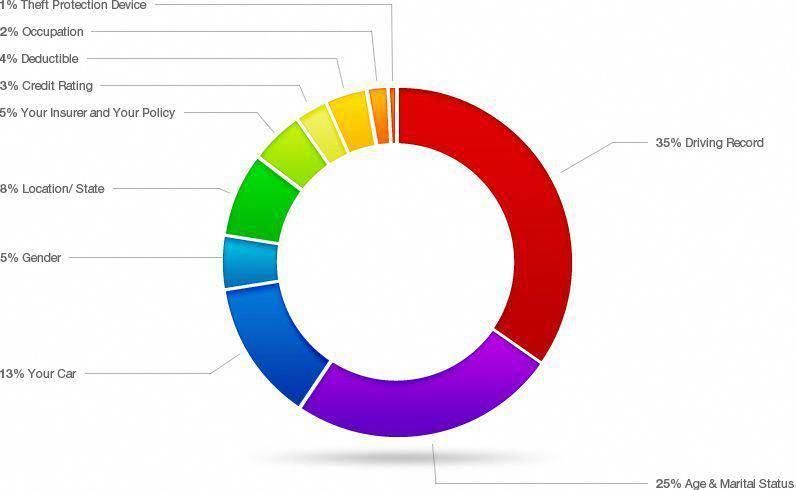

As mentioned earlier, there are many individual car owners who are charged more in lieu of their personal conduct.

Why is insurance so expensive for young drivers. However, once you start driving, you also need to get auto insurance. They tend to choose the latter. If buying insurance is simply too expensive for a young driver, being added to a parent’s policy can be a good way to save significantly on insurance costs.

Why is car insurance more expensive for young drivers? The type of car that young drivers drive will affect the cost of their insurance premiums. Why is insurance for young people so expensive?

Why is car insurance so expensive for new drivers? Why teens pay more for car insurance. So if you’re an older driver—and you are, the better your record is, the lower your insurance costs will be.

So why is car insurance so expensive? Young drivers are seen as a higher risk to insure because they have less experience on the road and are more likely to make a high value claim. Teens are young and inexperienced and still working their way up the ranks, so to speak.

Young drivers are less experienced on the roads, and are statistically more likely to be involved in an accident than those over the age of 25. Generally, car insurance for teens tends to be more expensive than it is for older drivers. If all new drivers are at an increased risk for accidents, why do young males pay the most expensive auto insurance premiums ?

So why is it so expensive to insure young people and are there ways to bring the cost of insurance down to an affordable level? One of the most exciting events in a young person’s life is getting her driver’s license. According to the insurance institute for highway safety, young drivers are far more likely to speed, to cause accidents and to be involved in serious crashes than their older counterparts.

Young drivers have some of the highest rates in the country, due in part to the increased likelihood of accidents and risky driving behaviors. This leaves insurance companies with a choice: Insurance companies take your credit history as a factor in your insurance premium.

Now you know why car insurance is so expensive for some drivers. Research shows that due to a lack of experience behind the wheel, young drivers get into more accidents than the average adult, which puts young drivers into a higher risk category. As a result, insurers are less eager to insure young drivers and charge high premiums to make it worth their while.

Well, the main reason is that young drivers, statistically speaking, are a higher risk for insurance companies meaning that they are more likely to become involved in serious accidents due to inexperience on the road. Just by looking at these figures, it’s easy to rile yourself up and assume that all insurance companies are out to bleed you dry. New or young drivers gives a financial risk to the insurance company

Basically, the statistics indicate the risk is higher when young drivers are driving. New drivers are more likely to engage in distracted driving behaviors: Why is van insurance so expensive for young drivers?

This is because they are statistically more likely to put in a claim Insurance companies have research and data to help them determine different rates for different groups of drivers. Distracted driving can take many other forms such as:

Why is car insurance so expensive for new drivers it depends on your background, your age and your driving record. The driver’s history shows them what could happen in the future if they provide the insurance coverage to the driver. For instance, cars that are at a high risk of theft such as sports cars will cost more.

Female drivers, in general, tend to get lower rates. They believe that insurance holders with a bad or no credit history tend to file more claims. Young drivers under the age of 25 are likely to pay a higher cost because they have less experience behind the wheel and are more prone to causing accidents.

Because as a group, young drivers are high risk. How much more expensive is insurance for young drivers? They assume that young drivers are more likely to be involved in accidents and/or drive recklessly, which although unfair is borne out by statistics.

Why is young driver insurance so expensive? Insurance companies view young drivers as high risk. This is the primary reason why young drivers pay a much higher premium for their insurance.

The statistical rate at which young drivers are more dangerous tends to drop around age 25, so many auto insurance companies offer lower rates to those who are 25 and older. According to uswitch, the latest data shows that young drivers are looking at average premiums of around £1,544.so, why exactly is it so expensive? Why is car insurance for young drivers so expensive?

Statistically speaking, young men are more likely to speed, drive recklessly, and otherwise make decisions that could lead to an accident behind the wheel of a car. New or young driver have less experience: Unfortunately, drivers aged between 18 and 25 are more likely to make an insurance claim than other drivers, and their claims costs may be a few times higher.

Either increase all premiums, or increase premiums for the drivers most at risk. However, there are ways teens can get affordable.

Tips To Get The Cheapest Auto Insurance Rates How to get

Wow check out this magnificent custom Malibu what an

HomeOwnersInsuranceFortLauderdale Auto Insurance Cartoon

Get Car Insurance With Suspended License With Most

Wonderful photo visit our review for much more

Tips To Get The Cheapest Auto Insurance Rates How to get

70 Awesome Car Insurance Quotes Young Drivers in 2020

Get Free Quote for Young Driver Car Insurance with Full

Head on Collisions Are You Entitled to Compensation

Tips To Get The Cheapest Auto Insurance Rates How to get

Why You Might Need Temporary Car Insurance Low car

Wowzas! I quite simply appreciate this color selection for

Compare Travel Insurance Quotes Quote & Buy Online UK

This Is Why You MUST Get A Comprehensive Car Insurance

As a driver, it can be hard to prove to insurers that you

Should Gap Insurance be on Your Car Insurance Policy